|  |  |  |

| |

|

|

||||||||||||||||||||||||||||||

Fassino

Real estate: ONLY ONE CONTACT FOR ALL DUBAI PROPERTY

Find your property we would like to visit | ||||||||||||||||||||||||||||||

| | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| WHY INVEST IN DUBAI | ||||||||||||||||||||||||||||||

|

-Real

Estate price is cheap compare to

others capitals around the word -Dubai real estate prices are going to

reach other capitals real estate prices.

-Tax Free Income -Major

company came to buy becaus Dubai

is a tax free Income like Microsoft. -Attractive

Currency Rates -The

local currency, AED (Dirham) is

fixed with the US dollar (3.675 AED: $1). -Population

is set to rise from 1.6 million to 3 million by 2010 -5

million tourists currently visit Dubai, expected to rise to 15 million by

2010 -Al-l

planning is Government controlled and completed in a

timely fashion . -40

Billion US dollars invested by the government in

Dubai Real Estate -Important

financial centre - many international companies outsourcing

operations in Dubai -High

rental yields on completed properties in well located areas of between 8 -

15 %per annum -Direct

flights from the UK and Ireland -Rapid

expansion and ongoing property development -

Dubailand, Sports City, etc. -Unparalleled

luxury for visiting tourists - Dubai has more leading

hotels of the world than any other country -Rental

income from property is a stable source of income, and while it might

fluctuate, is highly unlikely to vanish altogether. Compare that to

interest on

deposit accounts or dividends on shares. -Real

estate always has a residual value, although prices can certainly fall

as

well as rise. But property values will never fall to zero unlike shares

and

hedge funds. -Property

is a kind of hybrid asset with the capital appreciation of a stock but

the income producing capacity of a bond. -Investors

typically have more control over the nature, timing and size of real

estate investments. This is partly because they are tangible and easier

to

understand, and diversification is readily available in the form of

different

types of property. -Dubai

property is open to any investor from anywhere in the world, unlike the

local stock market. This means greater liquidity and more funds in the

marketplace. -Demand

for property typically picks up during an economic boom such as the one

being seen in Dubai now. With massive projects such as the Dubailand

theme

park, Palm Islands, and Dubai International Financial Centre coming to

fruition, this looks a wise time to invest in real estate. -Real

estate is always an excellent collateral security against loans, and

allows debt finance to be secured at the best rates. -Property portfolios offer great scope for diversification of risk into different property types, locations and rental levels. This helps to spread the risk of an interruption to income flow. | ||||||||||||||||||||||||||||||

DUBAI'S FREEHOLD

PROPERTIES

| ||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||

|

|  |  |  |

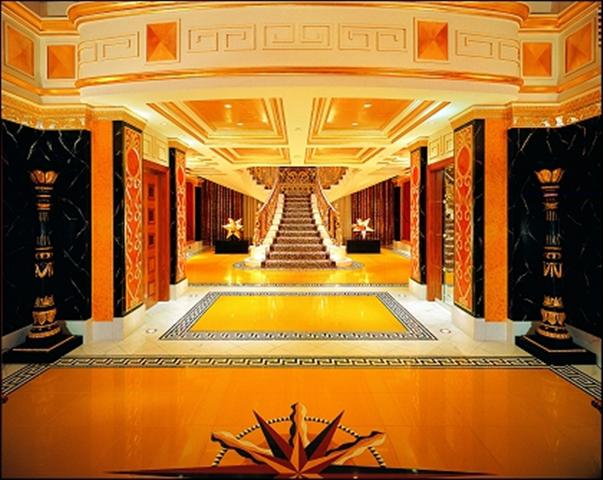

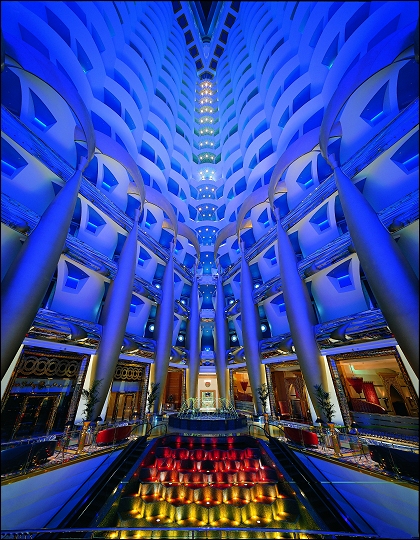

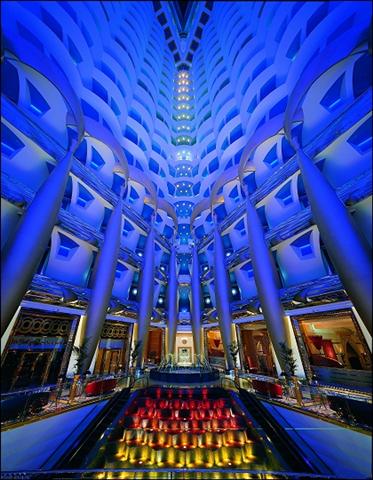

| Buri Al Arab Dubai | Buri Al Arab Dubai | Buri al Arab Dubai | Buri Al Arab Dubai |

|  |  |  |

| Buri Al Arab Dubai | Buri Al Arab Dubai | Buri Al Arab Dubai | Buri Al Arab Dubai |

|  |  |  |

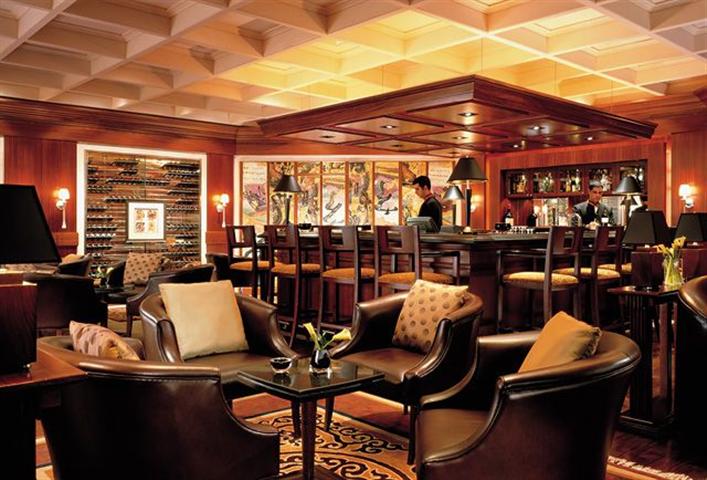

| Buri Al Arab Dubai | Jumeirah Beach Hotel Dubai | Jumeirah Beach Hotel Dubai | Jumeirah Beach Hotel Dubai |

|  |  |  |

| Jumeirah Beach Hotel Dubai | Jumeirah Beach Hotel Dubai | Jumeirah Beach Dubai | Jumeirah Beach Dubai |

|  |  |  |

| Jumeirah Beach Dubai | Jumeirah Beach Dubai | Jumeirah Beach Dubai | Jumeirah Beach Dubai |

|  |  |  |

| Jumeirah Beach Dubai | Jumeirah Beach Dubai | Jumeirah Beach Dubai | The Gate |

|  |  |  |

| The Gate Dubai | Dubai International City | Dubai international City | Buri Dubai |

|  |  |  |

| Buri Dubai | Buri Dubai | Buri Dubai | Knowlege village Dubai |

|  |  |  |

| Knowlege village Dubai | Knolege village Dubai | Knolege village Dubai | Ski Dubai |

|  |  |  |

| Ski Dubai | Ski Dubai | Ski Dubai | Ski Dubai |

|  |  |  |

| Ski Dubai | Mall of Emirates Dubai | Mall of Emirates Dubai | Ibn Battuta Shopping Mall Dubai |

|  |  |  |

| Emirates Tower Dubai | Sheikh Zayed Road Dubai | Emirates Tower Dubai | Emirates Tower Dubai |

|  |  |  |

| Dubai Sprt City | The Palm Dubai | The Palm Dubai | The Palm Dubai |

|  |  |  |

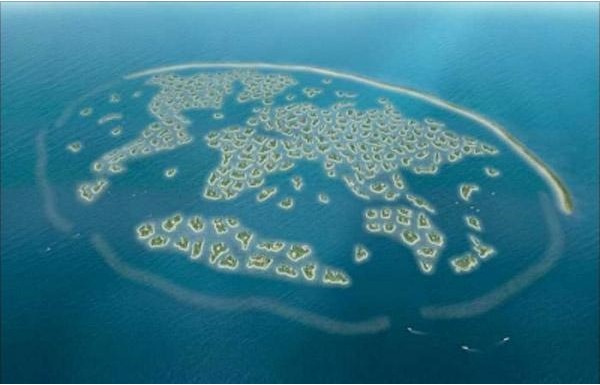

| The Palm Dubai | The Palm Dubai | The World Dubai | The World Dubai |

|  |  |  |

| Dubai photo | Dubai photo | Dubai photo | Dubai photo |